The Serve Pay As You Go Visa card is a great choice for those who may not have much of a credit history yet.

It’s easy to apply as one doesn’t need to have opened any long-term lines of credit beforehand. Serve Visa offers one of the first mobile payment solutions, with Pay-As-You-Go credit cards catering to those who wish to make their payments using their credit cards.

In December 2014, Serve Pay launched the “Save Your Selfie” campaign that gained major success with over 2 million people from over 75 countries contributing by uploading selfies with payment cards. The aim of the campaign was to immortalize these memories and it sure achieved it!

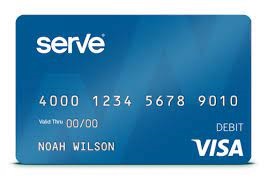

SERVE PAY AS YOU GO VISA

NO ANNUAL, MONTHLY OR INTERNATIONAL DEBIT CARD FEES NO ACTIVATION FEEVisa benefits

Serve Pay As You Go Visa is a great option for those who are trying to save money when withdrawing funds at ATMs. This card does not require a checking account balance or monthly fee, so you can get cash without having to worry about any extra costs.The great thing about this card is that it does not require any monthly fee and you can still take advantage of free online banking & payment services, usually only found with traditional bank accounts. Plus, best part – no hidden interest rates!

Visa Inc. is located in Foster City, California, USA and serves as the headquarters for the global not-for-profit corporation Visa International Service Association. When creating an account, make your first purchase with either a Visa Credit or Debit card. Visa is ubiquitous – they host the biggest market share of credit cards & even have their own prepaid debit cards. This way you can set up a convenient and secure payment method right away.

Serve makes it really simple to get started using their Visa card by not requiring a credit check. You can easily start off with a monthly load limit, for instance, you can initially load $200 onto your account & reload more money onto it whenever needed to make smaller purchases.

Distinctions

With a single account, you can store up to 30 different cards, making it an economical and practical gift card choice without a hefty activation fee.With this gift card, you can give the gift of choice to anyone in the world. There’s no purchase limit so your recipient can use it against any retailer of their choosing without any restrictions.

The Card Serve Pay As You Go Visa

With Serve Pay As You Go Visa, you can benefit from low interest rates and competitive fees for each purchase. This makes it easy to manage your budget without sacrificing quality. Serve Pay As You Go Visa can give you the financial freedom you need with just a single swipe. Whether it be an online or in-store purchase, this credit card comes with the right offer for you to use on all your needs. This deal is advantageous for those who use it for small purchases and don’t require a refund.

Pay As You Go Visa provides an easy and convenient way to stay on top of your finances. Just swipe your VISA Prepaid Card, make an online or offline purchase, and you can enjoy a 2% reward when you spend $200 – the offer is applicable for online transactions only. To purchase products, customers must look for items in the following divisions: Clothing & accessories, Home & garden supplies and Health & beauty products.

Applying for a credit card is hassle-free & easy. You don’t need to worry about having a spotless credit history or the highest scores. All you need is a SSN and proof that you’re 18 years old or above. Plus, with this card, there are no APR charges and no extra fees like most other cards out there.

Tips And Advice on Using Plastic Card in Hospitals:

- Although plastic payment methods have become common in hospitals, there are still some cases where cash is the only option. This could include situations when:

- The Serve Pay As You Go Visa prepaid card has numerous advantages. With its help, you can maintain control over your expenditure, use the funds to sample something new and at the same time put aside money for future needs – all of which are important in building a successful life.

The pros of the “Serve Pay As You go Visa”

- The card can be used in almost any location around the world.

- The Serve Prepaid card stands out from the rest of the prepaid cards offering no customs or duty fees.

- The great thing about this service is that it requires no monthly fees and offers a low purchase limit of $2,000 per month.

- When it comes to this card, you don’t have to worry about any monthly fees. That’s because there are no hidden charges or additional costs.

- those who want to buy their gift card can find it pretty easily online and you will also be notified when your order has been processed.

- Shopping for gift cards has never been easier. With the help of online stores, you can now purchase your desired gift card with just a few clicks. Not only that, you will also be notified when your order has been processed, so there’s no need to worry about the hassle of tracking it down. With this convenience and assurance, buying gift cards is now a breeze!

- It’s easy to locate Serve Prepaid cards since they’re widely available.

- You can find your desired item online, pay for it with a card at the store or even purchase it from convenience stores & gas stations nearby.

- Unlike with other prepaid cards, there’s no additional burden on you when it comes to custom and duty fees with this card.