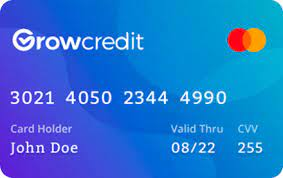

Grow Credit is revolutionizing the credit industry with its innovative approach. Instead of having to rely on your credit score, you can use your existing bank and subscription data to open a Grow Credit Mastercard account hassle-free. This is changing the way people access financial services.

Utilizing the Grow Credit card can be an effective way to increase your credit score. As you make payments on your streaming services with the designated Grow Credit Mastercard, you will gradually be able to raise your credit history.

Start off with the free version of Grow Credit Plan. You won’t be charged any Annual Percentage Rate fee and when you’re in a better financial situation, you can upgrade to one of the memberships plans to get additional benefits. To find out more about this card and how to apply, take a look below.

More about Grow Credit

The Grow Credit Mastercard makes life easier for those with low or no credit history. It is also great for newcomers to the U.S looking to establish their credit, as it does not require a track record of past accounts. With Grow Credit, you don’t have to worry about a thorough credit check or your credit score impacting your application. Moreover, making an application with us does not have any effect on your current credit score.

Additionally, the free plan on this card doesn’t need a security deposit which makes it affordable. Besides, there are three different membership plans with varied minimum payments ranging from $1.99 to $7.99 a month that can further be discussed later.

The Grow Credit offers an excellent free plan dubbed the Build Plan which entails an annual limit of $204 with a monthly spending limit of $17. In addition, it provides costless financial education and your FICO score at no charge. If you don’t find the membership plans interesting, this is a great alternative! Remember that all plans, including the free one report to the primer credit bureaus to increase your score.

The Grow Credit Membership Options

In addition to the Build Free Plan, the Grow Credit offers different levels of membership for those who need more features. The Grow Credit has three membership options available.

Even if you don’t qualify for the Build Free plan, there is still a great option for you. Build Secured plan only costs $1.99 a month, making it an affordable choice for anyone who wants to reduce their risk but still benefit from underwriting protectionThis plan provides a limit of $204 annually, with a spending limit of $17 per month. You need to make an initial security deposit of $17, which will be refundable after 12 months if you make your payments on time.

With Grow Membership, you will have access to a range of exclusive benefits such as premium subscriptions, discounts from chosen partners and periodic balance increase – all for just $3.99/month with an annual limit of $600 and a spending limit of $50 per month.

Get ready to save more with Accelerate Membership! With just $7.99/month, you’ll get an annual limit of $1,800 and a monthly spending limit of $150 – more than enough to keep your wallet happy! Grow Membership membership allows you to reap the many advantages that come with it, such as prime subscriptions. On top of that, you get exclusive access to another great feature – the ability to pay your bills through your mobile phone.

How to apply for the Grow Credit Mastercard

Applying for the Grow Credit Mastercard is a breeze – everything can be done swiftly and easily on the Grow Credit website.To activate your card, you’ll need to provide personal & financial details and sign up for at least one subscription. If you don’t have one yet, you can find plenty of Grow Credit partners on their website where you can create one.

To be eligible to receive your wage, you must possess a valid bank account, email address and phone number, U.S citizenship or permanent visa status and be 18 years of age or over. Moreover, you are also required to provide your social security number.

You can become a Gown Credit member without having any prior credit history. The company performs a soft credit check while you apply, but this is just to verify your identity and not to evaluate your current credit score. Initially, the yearly limit is set to a low value of $200 but with proper review in the following months, this can be increased.

Rewards and Fees of the Grow Credit Mastercard

With the Grow Credit Mastercard, there are no fees or APR required. Your bank will be connected to your card and because Grow Credit does not support balance carrying, they have a no interest policy in place.

The Grow Credit Mastercard is a great choice if you are searching for an unpaid card which will aid with credit history accumulation. Unfortunately, there are no refund or bonus programs included with this service, but this does not take away from the value of it.